Tax Information

IRS Form 1098-T

IRS Regulatory Reporting Overview

Per Federal regulations, Roger Williams University is annually obligated to provide all students enrolled in a credit bearing program with an IRS Form 1098-T. Depending on your income (or your family’s income, if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. You can find detailed information about claiming education tax credits in IRS Publication 970.

- All universities report Amounts Paid in Box 1 of the 1098T form (below). The amount paid in Box 1 is capped by Qualified Tuition and Related Expenses (QTRE) billed in the same calendar year (January 1 to December 31) and any unpaid QTRE from prior tax years (2018 forward).

- QTRE includes tuition and certain related expenses required for enrollment. Room, board and other fees are not considered qualified expenses.

Calendar (Tax) Year 2024

When you make payment for the spring and winter 2025 terms affects your 1098-T. The spring and winter 2025 terms are billed on December 1, 2024. The payment due date for the spring and winter 2025 terms is January 3, 2025. The following scenarios may impact when and how you make payment.

- If you make payment in December 2024 for spring or winter terms that are billed in 2024, the payments will be included in the 2024 1098-T calculations.

- If you make payment in January 2025 for spring or winter terms that are billed in 2024, any unpaid applicable charges (QTRE) from 2024 will carry forward to 2025, so the payment will be included in the 2025 1098-T calculations.

- If you are concerned about the payment posting date, online checking or credit card payments will post to your account immediately. Paper check payments arriving after December 23 will not be applied to accounts until January (due to the university closure).

Roger Williams University is unable to provide you with individual tax advice, but should you have questions, you should seek the counsel of an informed tax preparer or adviser.

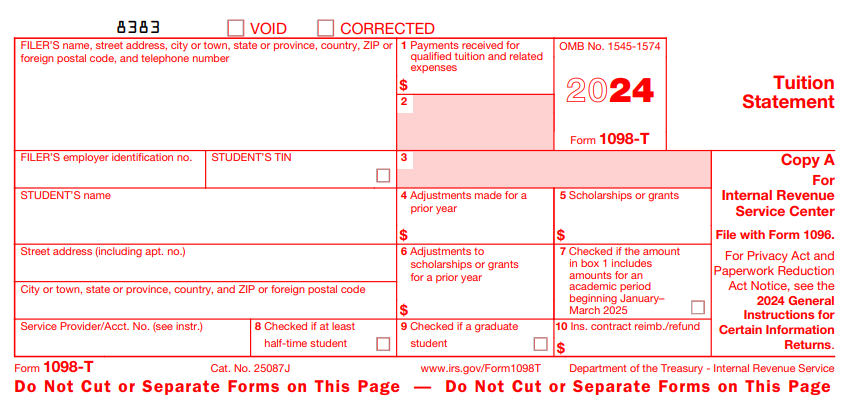

Below is an image of a blank 2024 Form 1098-T that you will receive in January 2025. For more information about Form 1098-T, visit IRS Form 1098-T.

The 1098-T for calendar year 2024 will be available no later than January 31, 2025. We will send students an email notice when the form is available online on the RWU Student Account Center (SAC). The form can be printed from the SAC. If you requested to have your 1098-T mailed, it will be mailed to the student’s address on record by January 31, 2025.

IRS Form 8300

RWU is required by law to report receipt of more than $10,000 in cash over a course of any 12 month period to the IRS by filing an IRS Form 8300. Cash (currency), Money Orders, Cashier’s/Treasurer's checks and Traveler’s checks are considered cash payments.

Personal and corporate checks are not considered cash payments. Students will be notified by the University Bursar’s Office if a Form 8300 has been filed.